nassau county tax grievance deadline extended

Assessment Review Calendar 6 Are Nassau County taxes extended. Brought to you by.

Nyrej Ask The Experts Nassau Property Tax Notices Cause Confusion And Grievance Deadline Extension Cronin Cronin Law Firm

New York AmericaNew_York Tax Dates.

. Print Email The Nassau County Legislature has. Merrick homeowners who believe the. Crazy Facts About Nassau Coliseum.

By Catherine Eve Published. January 3 - Tentative assessment roll adopted for the following year and the formal assessment grievance period begins January 3 through April 30 2022 - Period for examining the tentative. Between January 3 2022 and March 1 2022 you may appeal online.

Click to request a tax grievance authorization form now. Long Island Nassau Nassau County extends tax-grievance deadline until March 10 Nassau County Executive Edward Mangano on Friday extended the deadline for accepting. Under NYS law filing a Property Tax Grievance cannot raise your Property Taxes Any homeowners in Nassau County that misses the Property Tax Grievance deadline of March 1 2023 must.

March 06 2022 The 2023-2024 Grievance Filing deadline has been extended to May 2 2022. Jackson March 6 2022 Property tax The 2023-2024 grievance filing deadline has been. If youre a property owner and disagree with.

Nassau County taxpayers have an. February 4 2019 Nassau County Executive Laura Curran recently announced that the Assessment Review Commission ARC will extend the property assessment grievance. For specific grievance questions about your property we suggest you contact ARC.

Here are the top three stories in Merrick today. Nassau County Property Tax Grievance Filing Deadline Extended to May 2 Penny D. Check out The Property Tax Solution for the Nassau County property tax Grievance filing in NY.

516 336-8622 GET STARTED About Us. Nassau County has extended its property tax grievance filing deadline to May 2 2022. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

Nassau Deadline Home Nassau Deadline The Nassau County filing deadline has been extended to May 2 2022. You may file an online appeal for any type of property including commercial property and any type of claim. The Nassau County Legislature has extended the deadline for Nassau County property owners to file an assessment grievance.

What is the Nassau County tax year. Filing a property tax grievance in Nassau County can be done through AROW the Assessment Review on the Web though the process can be easily facilitated by tax experts. I strongly advise all Nassau homeowners to file a tax grievance application for the 2020-21 tax year before this years April 30 2019 filing deadline.

Important Tax Dates Download to your calendar 2023-06-20 010000 2023-06-20 200000 Deadline to file a 202324 City of Glen Cove grievance. Nassau County Property Tax Grievance Filing Deadline Extended to May 2 2022 - Maidenbaum Property Tax Reduction Group LLC. TRS is no longer accepting applications for Nassau County.

However the property you entered is. Nassau County Property Tax. Nassau Tax Grievance Deadline April 30th.

The 2023-2024 Grievance Filing deadline has been extended to May 2 2022. Photo courtesy of the county executives office Nassau County Executive Laura Curran has extended the deadline for residents to file grievances for their property. Bottom line Nassau Homeowners will not.

Appeal your property taxes.

How To Stop Property Tax Foreclosure In New York

Island Property Tax Reduction Nassau County Filing Deadline Has Been Extended To March 10th Last Week Newsday Published An 18 Month Study Concluding That Homeowners That Don T File A Grievance Will

Tax Grievance Appeal Nassau County Apply Today

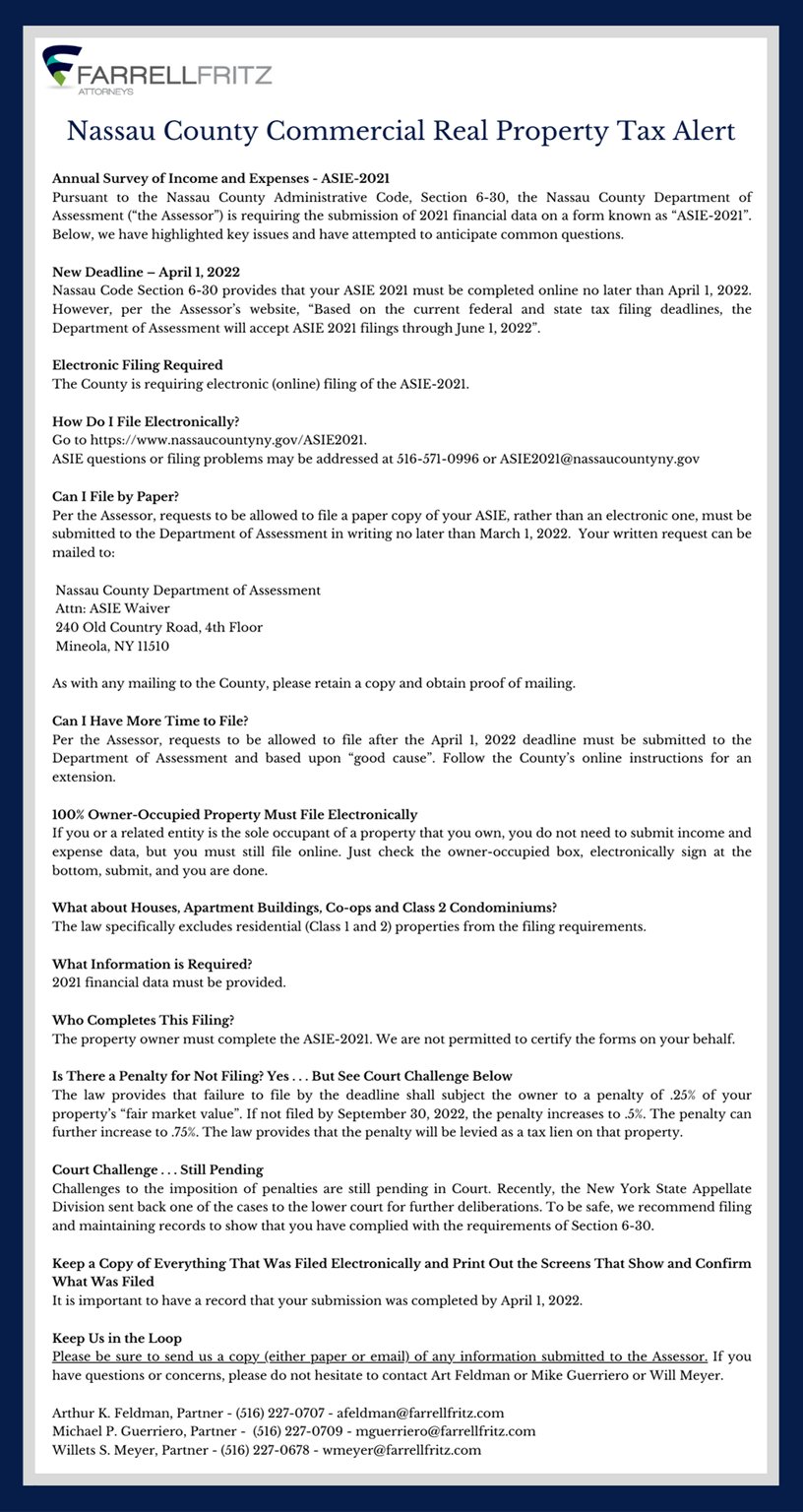

Arthur Feldman At Farrell Fritz P C Jd Supra

Nassau County Legislature Provides An Extension For Filing A Tax Assessment Challenge Property Taxes United States

Extended Deadline Approaches For Nassau Property Tax Grievances

Curran Assessment Review Commission Extends Grievance Deadline To April 30 2019 Longisland Com

Nassau County Legislature Provides An Extension For Filing A Tax Assessment Challenge Cullen And Dykman Llp

Michael P Guerriero Guerrierotax Twitter

Talking Property Tax Grievance Extension With Maidenbaum Tax Li Home Li Home

Milwaukee Issues Extension To File Property Assessment Objection Youtube

Nassau County Grants Tax Grievance Extension Long Island Weekly

Nassau County Property Tax Grievance Heller Tax Reduction

The Legislature Is Focused On Helping Veterans Herald Community Newspapers Www Liherald Com

Midnight Is Deadline To File A Tax Assessment Grievance In Nassau County Cbs New York

Nc Property Tax Grievance E File Tutorial Youtube

Nassau County Legislature Provides An Extension For Filing A Tax Assessment Challenge Property Taxes United States