estate tax exclusion amount sunset

1 2026 the federal exemptions will reduce to 5000000 as indexed for inflation. At a tax rate of 40 thats a 72 million tax bill.

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

This piece of mind however severely decreases after December 31 2025.

. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Even then only the value over the exemption threshold is taxable. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

For people who pass away in. With inflation this may land somewhere around 6 million. The new numbers are 112 million for an individual and 224 million for married couples.

This gives most families plenty of estate planning leeway. The exemption amount will be cut in half for each taxpayer and is estimated to be around 62 million in 2026 after adjusting for inflation. Individuals can transfer up to that amount without having to worry about federal estate taxes.

The IRS formally made this clarification in proposed regulations released that day. This expanded exemption has a sunset provision which means it will revert back to the 2017 exclusion amount in 2026. The amount a person can pass on before facing taxes is known as the lifetime gift tax exemption The graph below illustrates how the lifetime gift tax exemption grew between 2000 and 2022.

After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. In particular for decedents dying and gifts made after December 31 2017 and before January 1 2026 the basic exclusion amount is increased by 5 million to 10 million as adjusted for inflation. BOSTON JUNE 21 2022The odds of estate tax reform appeared to improve Tuesday and a potential tax relief package could also feature some ideas that havent yet been publicly floated.

Under current law the estate and gift tax exemption is 117 million per person. The limits in 2017 for the estate gift and generation-skipping tax were 5490000 per person and 10980000 for a married couple. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

This change will not only affect estates over the. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. The estate tax exemption is adjusted for inflation every year.

The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been increased for inflation beginning January 1 2022. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. The 2022 exemption is 1206 million up from 117 million in 2021.

If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount. A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemptions to 1118.

Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. Congress included a sunset provision in the 2017 Tax Act so the exclusion amount returns to the 2017 exclusion amount. 2 Presidential candidates various proposed changes to the estate tax law have included reducing the estate exemption amount to 1 million 2 million or 35 million and raising the estate tax rate to 45 or higher all the way up to a top rate of 77 for estates over 1 billion.

The current estate tax exemption is 12060000 and double that amount for married couples. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. 115-97 TCJA amended the basic exclusion amount.

The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift. What happens to estate tax exemption in 2026. The changes though significant will affect only a small.

The credit to be applied for purposes of computing As estate tax is based on the 68 million basic exclusion amount as of As date of death subject to the limitation of section 2010d. Importantly the estate tax exemption is portable. In the meantime the new exemption rate decreases the number of estates impacted by this tax from 5000 to approximately 2000.

As you can see the biggest leap occurred in 2018 after the Tax Cuts and Jobs Act TCJA took effect. You can gift up to the exemption amount during life. 20 2018 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels.

The federal estate tax exemption for 2022 is 1206 million. The exemption limits will rise annually reflecting inflation. October 14 2020.

Individual Bs predeceased spouse C died before 2026 at a time when the basic exclusion amount was 114 million. For instance a married couple can effectively shelter up to 228 million from gift and estate taxes in 2019. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

The first 1206 million of your estate is therefore exempt from taxation. 2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts.

However in 2026 the exemption is set to return to the 2017 level of 5. 2022 Estate Tax Exemption. The size of the estate tax exemption meant that a mere 01 of.

The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018. The regulations implement changes made by the. The 2017 tax law commonly referred to as the Tax Cuts and Jobs Act Pub.

It is invested and managed just like Option 1. Additionally several candidates have proposed a progressive. The exemption for married couples is 22800000.

However the TCJA will sunset on Dec. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

Tax Benefits Georgian Bay Land Trust

Recent Changes To Estate Tax Law What S New For 2019 Jrc Insurance Group

Offshore Tax Havens Myth Vs Reality Cbc News

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Check Below Chart For Indicative Tax Threshold Changes

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DI3Z6DDW7RNAJEKK624FMGNV64.jpg)

Transgender Women Unable To Compete In British Cycling Events As Policy Suspended Reuters

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Spousal Lifetime Access Trusts Slats Creative Planning

A Great City Has Been Defaced Why Has A Poo Emoji Arrived On Edinburgh S Skyline Architecture The Guardian

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Preparing For Life S Milestones

Charity In The New Estate Tax Environment How To Save Tax Deductions

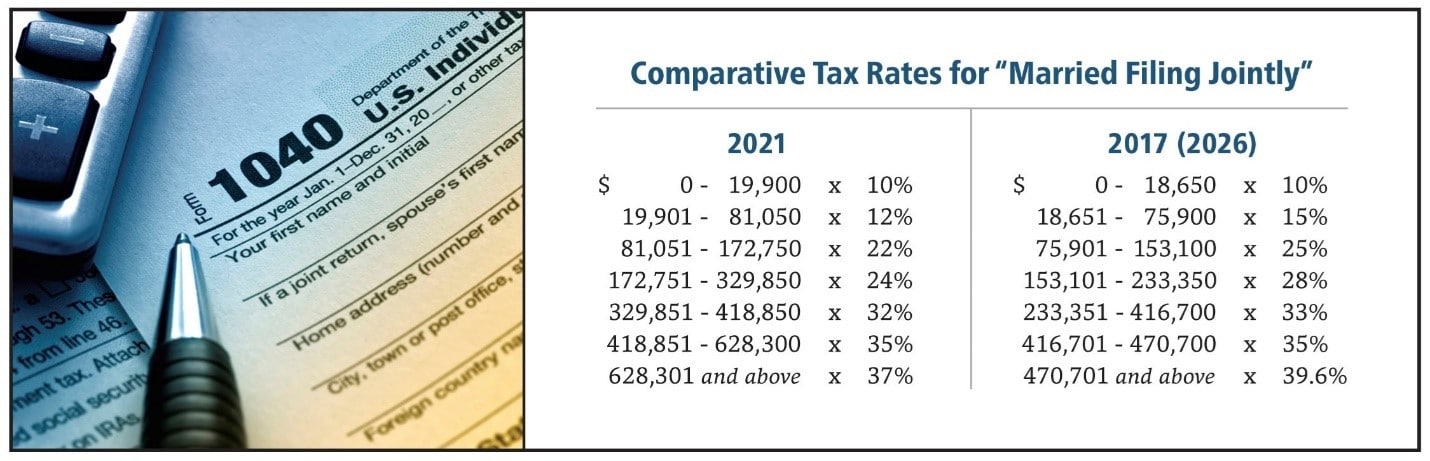

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Charles Sampson Group Of Charter One Realty Realty Hilton Head Island Real Estate Marketing

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire